“Web3 sucks.”

“Oh, so you’re ok with Amazon and Google controlling the entire internet?”

It’s difficult to get your average Web3 proponent to sit down and explain what it is, or what problems it aims to solve, but from the common hand-wavy responses you can get an idea. Web3 is a response to big tech. They’ve become to powerful, they control everything, promote what they want, censor that which they don’t like. Web3 is our escape.

…or something like that.

A quick explainer of the core components of Web3

Web3 is a collection of several blockchain related technologies, which could, in theory, provide the foundation for a better internet. That’s not quite what happened, and we’re going to take a look at why.

But first, a quick introduction to some relevant terms.

Cryptocurrency

The first of the new technologies was cryptocurrency, a decentralized, trustless, digital currency. Instead of having a payment processor, payments are published to a decentralized ledger and validated by the community. Because validators either work together or compete to validate the same entries, it doesn’t matter if someone tries to cheat the system. The validators essentially form an implicit democracy where there must be a consensus on what is correct. With no central authority or payment processor, users are free to transfer and spend cryptocurrency however they wish. It provides freedom from censorship and regulation. With almost all digital payment processing handled by private companies, there is a real issue with their ability to deny financial services for any reason.

I actually experienced this personally. In 2017 I was charged with criminal hacking. Before I’d even made it to court, one of my banks had terminated all of my accounts. I quickly learned that because this was a private company and banking is not considered a right, there was no recourse regardless of if the courts found me innocent or guilty. I was simply just left with no credit cards, no bank account, and no way to pay bills. It was crazy to think that in a society where almost all money is digital, I could just be left completely cut off from the financial system.

Non-Fungible Token

Non-Fungible Token, or NFTs, work in the same way as cryptocurrency, but rather than divisible units of currency, they are singular tokens. The token cannot be forged, replicated, or destroyed; but can be freely transferred between people via a blockchain, just like bitcoin. An NFT usually represents either ownership or rights to some underlying good or service.

Imagine you wanted to host a comedy event with 200 guests. You don’t necessarily care who the guests are, only that there are only 200 of them. You could sell or give away 200 NFTs tickets, which the receivers would then be free to transfer or sell to others (without the need for reliance on a 3rd party platform). Whoever provides you the NFT at the door is a welcome guest, and there is no way for people to forge or replicate tickets to gain access. The possibilities for NFTs were endless, but unfortunately they only became widely used for one thing, which we’ll talk about later.

Decentralized Autonomous Organizations

Again similar to cryptocurrency, and NFTs, you have DAOs. DAOs are a bit like publicly traded companies. Public companies issue shares, which represent a fraction of ownership in the organization. The shares typically provide voting rights, and the more shares you hold, the more your vote is worth. Shareholders then meet to vote on organizational decisions. DAOs are essentially this, but with NFT-like tokens in place of shares. Instead of shareholder rights being defined by law, they’re defined by code.

Where it all went wrong

In theory, the technologies that make up Web3 provide a way for internet technologies to be operated in a completely decentralized and democratic way. The reality though, is anything but.

Crypto currency commodity

Bitcoin was the first cryptocurrency, but it was also fundamentally flawed. With fiat currencies, you have a central authority capable of printing or destroying money at will. Many cryptocurrency proponents will argue against the existence of such entities, but they are needed for a stable economy. For a currency to be usable, there must be a means to protect again both inflation or deflation. After all, why spend $1 which will be worth $2 tomorrow, or why save $2 which will be worth only $1 in a week. For a currency to be useful, there must be a healthy balance between supply and demand.

Bitcoin is highly sensitive to demand. The code creates a fixed number of coins with every block, but this number does not scale with adoption. Essentially, what happened was as more people adopted bitcoin, the demand increased far faster than supply, causing the value to skyrocket. People immediately realized that they could make money by simply buying and holding bitcoin. With far more people willing to buy bitcoin than sell it, the price continued on the up and up.

Almost everyone has heard the story of the famous bitcoin pizza. A man who purchased a Pizza for what, at today’s price, would have amounted to $164,253,239 worth of bitcoin. Often, this story is one of ridicule, a fool who spend $100m on pizza when he could have gotten rich. But this was the first documented use of bitcoin as a currency, it is what proved bitcoin’s utility and made it what it is today. As you can probably already see, a lot of the mentality is wrong. Bitcoin is treated as an asset due to its deflationary nature, and those using it for its intended purpose are often mocked.

Even if every person on earth had gotten into bitcoin, the price would not have stabilized once adoption did. With bitcoin being seen as an asset to trade, it is susceptible to constant fluctuations in demand as holders buy and sell in an attempt to one up each other. Eventually, stablecoins were invented, but by then seeing cryptocurrency as a speculative asset was already the norm.

The NFT art Ponzi

Bitcoin was of course, only the beginning. But it had already set in motion a large movement focused on using blockchain technologies for wealth accumulation, rather than decentralization. These are fundamentally opposed ideologies, but we’ll get to that part.

The same mindset that turned cryptocurrency into a casino immediately poisoned the NFT space. There are so many potential prospects for the technology, but they were drowned out by get rich quick schemes and people trying to buy social status. Even the phrase NFT became synonymous for paying millions of dollars for ugly drawings of apes or goofy bug-eyed cats. I’m not even saying the idea of NFT art is bad, maybe there is a place for it. But most people weren’t buying art to enjoy. They were buying an asset in which their only belief was their ability to sell it to a greater fool for more.

The NFT technology could have caught on, maybe it still can, but currently the space is overrun by people playing hot potato with worthless jpg hashes. Even as a strong believer in the technology, I struggle not to cringe upon hearing the term NFT. In order for the technology to catch on, I think a complete rebrand is likely necessary.

Decentralization is only temporary

The core selling point of Web3 is decentralization, but this is only the initial and temporary state of blockchain based architecture.

Miners are paid for contributing their computing power towards maintaining a blockchain. The more money they make, the more computing power they can afford to contribute; the more computing power they contribute, the more money they make. The same is true for exchanges. Exchanges can advertise to increase their customer base, which increases their income, and thus their ability to advertise. Exchanges usually also end up buying other platforms to integrate into their own, further increasing their market share. DAOs suffer from the same issues as regular companies. Groups can either buy up all the voting shares and control the organization, or simply influence voters to do their bidding.

The entire crypto-economy simply just mimicked the early stages of a free market. Then we got to watch in warp speed as everything centralized around a few major players. If fact, it can be argued that the only thing preventing outright monopolies in web3 is conventional antitrust law.

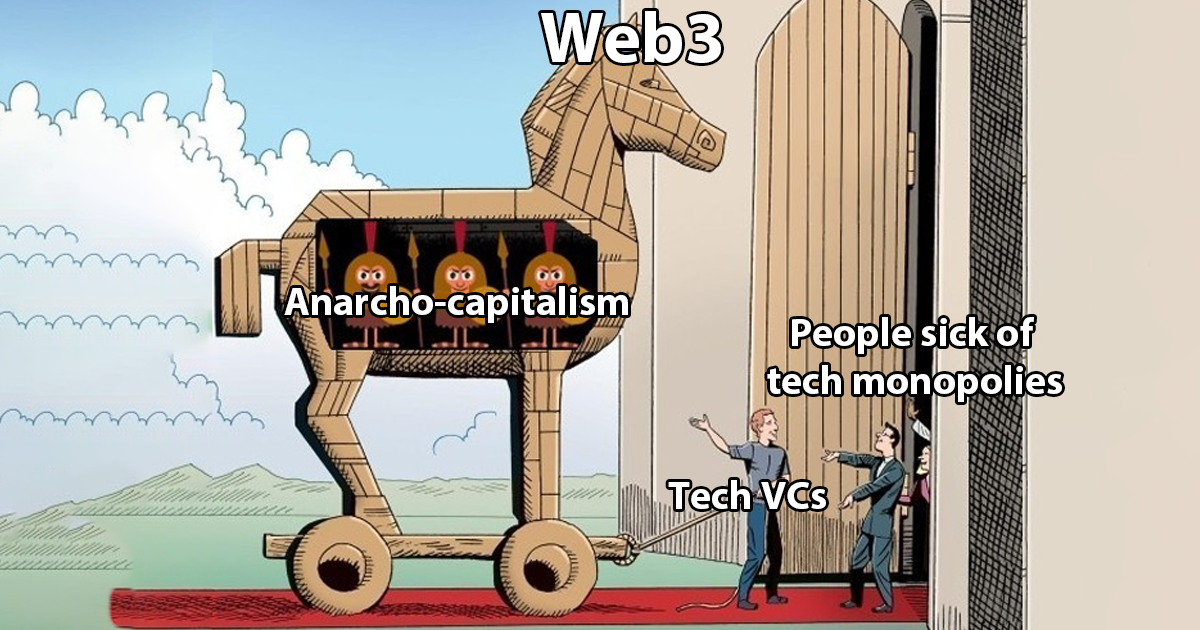

The fact that the decentralized web isn’t decentralized is not a secret. Plenty of people can see that Web3 is centralizing far faster than Web2 ever did, they simply don’t care. They’re hoping to position themselves in such a way that they either become part of the monopoly, or at least get bought out for a nice chunk of change along the way. Web3 is, at its core, just a get rich quick scheme masquerading as an escape from the tyranny of big tech. Probably the most telling part is the fact the same VCs who became billionaire centralizing Web2 are welcomed with open arms to Web3.

A tech solution to a people problem

Proponents often argue that while there is only one major NFT marketplace, you can sell your NFT elsewhere. Or that while a single exchange may account for 50% of cryptocurrency trading volume, you can buy and sell cryptocurrency elsewhere. This same argument is also true for the conventional web. There is a reason why people who have their NFTs stolen beg for OpenSea to freeze them, or exchanges to freeze transfers involving stolen coins. Without access to centralized marketplaces, these high value items become essentially worthless.

I’m writing this blog from a VPS I set up myself running only free open source software. I can also set up some servers in my house and make my own AWS, my own Facebook, my own payment processor. The limitations on me doing those things are not technical, they are financial and social. Why would people use my ISP when AWS is so reliable? Why would people use my Facebook when everyone is on the real thing? Why would people use my payment processor when visa and mastercard are so fast and cheap.

Decentralization requires fighting both financial and social incentives. Even in lieu of the capitalist goal to accumulating resources, humans will naturally centralize. We hear about new ideas and places from our peers, and we go where they go. There is a reason a decentralized network of Bulletin Board Systems turned into Twitter & Facebook. Almost none of us are paid to be there, and these platforms are detrimental to our mental health, but we go because that’s where the people go.

Web 3 really just feels like a bunch of extremely confused anarcho-capitalist libertarians stumbled across socialism and are now trying to re-draw it from memory. The technology faces all the same problems as Web2 did (plus many new ones), but is being sold to us as a complete and total solution to human nature.